World’s first P2P Agent based DEX

Mettalex offers a next-generation trading experience in DeFi, combining Fetch.ai's advanced agent-based technology with a seamless, secure platform for efficient chain agnostic trades.

Understanding Mettalex

Check out what Mettalex has to offer and how it works. Mettalex provides a next-generation trading experience in DeFi.

Mettalex Docs

Explore our comprehensive guides to kick-start your work with Mettalex. Acquire the knowledge and resources necessary for efficient development and implementation.

Getting started with Mettalex 101

Initiate your journey with Mettalex by integrating your digital wallet, engage in synthetic commodities trading, and depend on blockchain-powered smart contracts for clarity.

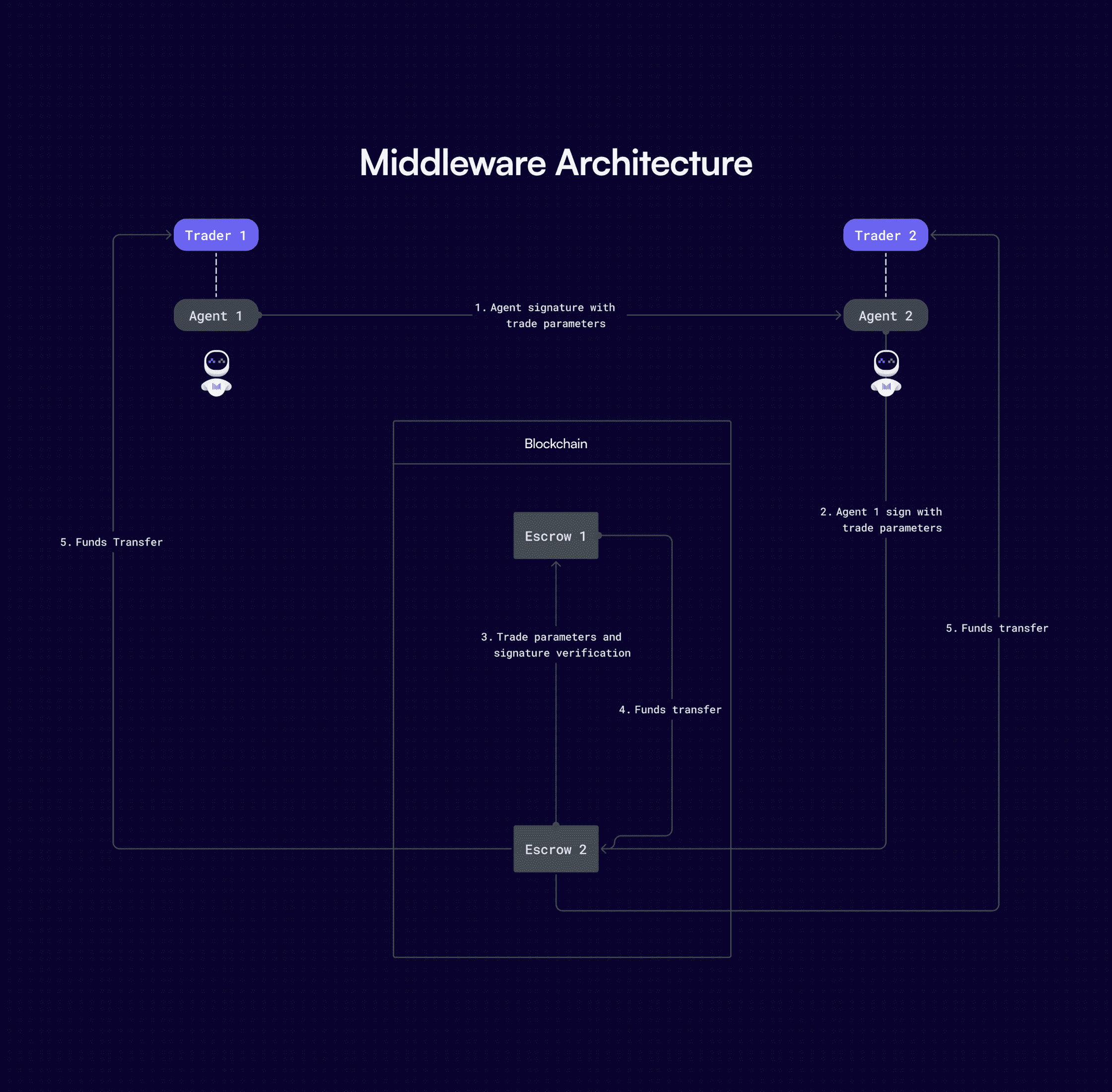

The Middleware Architecture

Mettalex's intermediary structure enables initiation of trades, alerting agents, pairing of orders, and safe transaction of funds through integration with the blockchain.

Our mission is to empower traders by simplifying cross-chain digital asset trading, reducing intermediaries, and increasing user control through AI-driven decentralized technology.

Check out our latest blogs

Check out our latest blogs for insights, updates, & expert tips on DeFi & trading!

Know more about us

Whether you're a developer, trader, or DeFi enthusiast, connect with Mettalex on social platforms for updates and community engagement.

Connect with us on Discord

Connect with traders and developers, share insights, and stay updated with the latest news.

Join our Discord

Follow us on X (Twitter)

Get the latest updates, announcements, and product insights by following us on X formerly Twitter

Follow on X

Join Our Telegram Group

Engage with our community on Telegram for real-time discussions and product updates.

Join Now on Telegram